Tokenomics is a term used to describe the economics of a blockchain and its associated tokens. It is the study of the design and implementation of token economics, which is the core of the blockchain. Tokenomics looks at the different ways tokens can be used to create an economic ecosystem within the blockchain, including how tokens are created, distributed, and exchanged. Tokenomics also looks at the incentives, rewards, and economics of the blockchain and its associated tokens, as well as the effects of tokenomics on the blockchain and its users. Tokenomics looks at the interaction between users and the blockchain and how this interaction affects the overall economy of the blockchain. Additionally, tokenomics also looks at the effects of the blockchain on other industries, such as banking and finance.

What is Tokenomics?

Tokenomics is the economics of digital tokens, often related to cryptocurrencies and blockchain technology. Tokenomics is the study of the economics of the issuance, distribution, and circulation of tokens of value, such as those associated with cryptocurrency networks. Tokenomics typically looks at the economic incentives and disincentives associated with the issuance and use of tokenized assets, as well as their impact on the underlying blockchain network. It also covers the design of token models, the security of token systems, the governance of token ecosystems, and the monetization of token networks. Ultimately, tokenomics seeks to create economic systems that are secure, reliable, and beneficial for all stakeholders.

Features of Tokenomics

Mining and staking :

Mining and staking are two of the most important and widely used methods in tokenomics. Mining involves using computing power to solve complex mathematical problems to secure a blockchain network and generate tokens as rewards. Staking is the process of locking up tokens to receive rewards in return. Staking can be used to increase the security of a network, and also to create a decentralized governance system. Both mining and staking are integral parts of tokenomics and are essential for the long-term success of a blockchain network.

Yields:

Yields in tokenomics are a relatively new concept in the cryptocurrency world. Yields refer to the amount of income generated from a given asset. Tokenomics is a field that focuses on the creation and management of tokens and their associated economic incentives. Yields from tokenomics can be generated from staking, airdrops, liquidity mining, and more. Yields from tokenomics can be quite lucrative and offer investors a way to generate passive income from their holdings. Yields from tokenomics can be a great way for investors to diversify their portfolios and generate income without having to actively manage the assets.

Token burns:

Token burns in tokenomics are a form of yield farming that allows users to earn rewards by burning tokens. This process can be used to stimulate deflationary effects, reduce the total supply of tokens, and increase the price of the remaining tokens. By burning tokens, users can increase the price of their tokens in the market and increase the value of the tokens they have. Token burns also benefit the platform by increasing the demand for the token and creating a more stable market. Ultimately, token burns help create a healthier and more stable token economy.

Limited vs unlimited supplies:

Tokenomics is a term used to describe the economic aspects of a particular cryptocurrency or a token. It is a combination of token supply, circulation, and market demand that determines the value of the token. One key element of tokenomics is limited vs unlimited supplies. A limited token supply is when the total number of tokens is capped and there is no way to increase the supply. This creates scarcity, making the tokens more valuable. On the other hand, an unlimited token supply is when there is no limit to the total number of tokens that can be created, meaning the supply is constantly increasing. This can cause the token’s value to decrease due to inflation. Limited vs unlimited supplies are important considerations when creating a tokenomics model.

Token allocations and vesting periods:

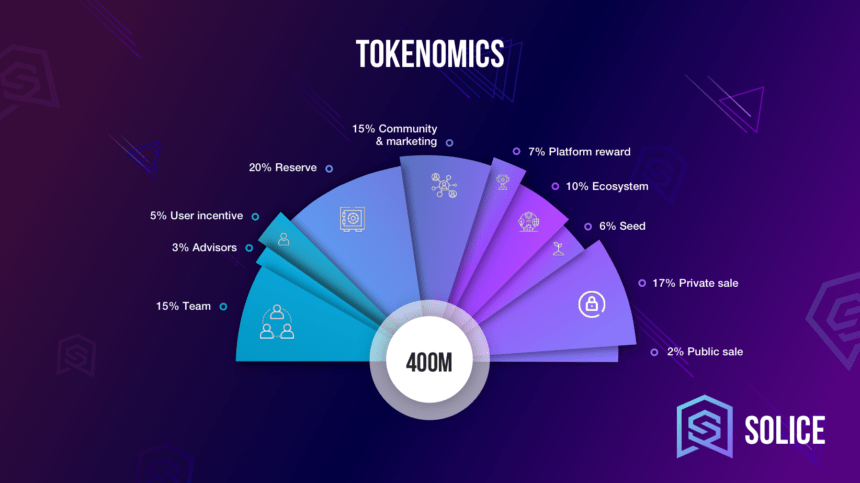

Tokenomics is the economic model of a token-based project or network. One of the main components of tokenomics is the token allocation and vesting periods. Token allocation is the process of dividing the total number of tokens in a project among various stakeholders, such as developers, investors, and advisors. Vesting periods are set periods in which a portion of tokens are released to stakeholders, based on predetermined criteria. This ensures that the tokens are distributed over some time to ensure that stakeholders have a vested interest in the project and understand the potential value of the tokens. This also helps to prevent market manipulation and speculation.

Tokenomics and Cryptocurrency

Tokenomics is the economic analysis of digital tokens, which are the units of digital currency created and used in cryptocurrency networks. Tokenomics is a relatively new concept and focuses on the financial aspects of cryptocurrency networks, including the creation and distribution of tokens, how they are used and traded, and the economic incentives for users of the network. Cryptocurrency networks are being explored and implemented by many organizations, from banks to governments, to increase efficiency, reduce costs, and ensure secure transactions. Tokenomics is a crucial element of the success of these networks, as it helps to ensure the long-term sustainability of the network and the economic incentives for users.

Advantages of Tokenomics

Tokenomics is the study of a token-based economy, which is becoming increasingly popular in the cryptocurrency world. Tokenomics offers many advantages, such as improved liquidity, decreased transaction fees, and access to a global market. Improved liquidity means that tokens can be exchanged more easily, allowing users to access and transfer funds quickly. Lower transaction fees make it easier for users to make transfers and use services offered by tokens. Finally, tokenomics opens up access to a global market, allowing for easier and quicker access to new markets and services. This makes it easier for businesses to expand their reach and increase their customer base. Tokenomics is an important tool for any business or individual looking to gain a foothold in cryptocurrency.

Impact of Tokenomics on Cryptocurrency Markets

Tokenomics is the study of economics and incentives related to the use of tokens in a cryptocurrency system. It is a key factor in the success of cryptocurrency markets, as it affects how investors view and interact with the cryptocurrency in question. Tokenomics helps to create incentives for users to use the token, and these incentives can vary depending on the project and its goals. For example, some tokens may have an inflationary structure, while others may offer rewards to holders in the form of dividends or staking rewards. In addition, tokenomics helps to ensure the liquidity of the market, as well as the security of the technology. All of these factors can have a significant impact on the success of a cryptocurrency market, and tokenomics is an integral part of this success.

Tokenomics and Regulatory Compliance

Tokenomics and Regulatory Compliance are two topics that are becoming increasingly intertwined as the blockchain and cryptocurrency space continues to grow. Tokenomics is the study of how tokenized assets are used in the economy, and Regulatory Compliance is the adherence to laws and regulations governing the use of such assets. Understanding the concepts of tokenomics and regulatory compliance is essential for businesses looking to enter the blockchain and cryptocurrency space. This includes understanding the potential risks associated with tokenized assets, as well as the potential regulatory requirements that may need to be met. Companies must ensure that their tokenomics strategy is compliant with the relevant laws and regulations to protect their assets, their customers, and their operations.

Tokenomics and Digital Identity

Tokenomics and Digital Identity are two powerful concepts that are increasingly gaining attention in the digital economy. Tokenomics is the process of creating, managing, and distributing digital tokens to incentivize a network of actors. Digital Identity is the use of digital credentials to verify the identity of a person, device, or other entity. Together, these technologies have the potential to revolutionize the way we interact, transact, and do business online, as they can provide unprecedented levels of trust, security, and privacy. Tokenomics and Digital Identity are key components of modern digital economies and are likely to become even more pertinent shortly.

Tokenomics and Security

Tokenomics is the economic analysis of tokens, which are digital assets that are used to facilitate transactions on a blockchain network. Tokenomics helps to ensure that the network is secure and has a consistent value. It also helps to incentivize users to participate in the network, as token holders are rewarded for their contributions. Tokenomics is important for security because it helps to provide an incentive to users to act in the best interests of the network. By providing a reward system, users are incentivized to protect the network from malicious attacks and other forms of fraud. Tokenomics can also be used to help reduce the risk of financial losses from volatile markets, as tokens can be used to hedge against market volatility.

Tokenomics and Privacy

Tokenomics and privacy are two important concepts in the blockchain world. Tokenomics involves the economics of a blockchain network and the tokens used within it. It includes the pricing, supply, and demand of tokens, as well as the economic incentives built into the network. Privacy is a key concept in the blockchain world, and technologies such as zero-knowledge proofs and ring signatures are used to ensure that transactions on the blockchain remain anonymous. The combination of tokenomics and privacy can be used to create a secure and anonymous network where users can transact with each other without having to reveal their identities.

Tokenomics and Decentralized Governance

Tokenomics and decentralized governance are two important concepts in the cryptocurrency world. Tokenomics is a term used to describe the economic principles and practices that are used to guide the design, distribution, and circulation of tokens within a blockchain network. Decentralized governance is the process in which decisions are made and implemented within a decentralized network without needing a centralized authority. By combining tokenomics and decentralized governance, cryptocurrency networks can provide secure and transparent transactions, as well as the ability to quickly and efficiently update the network as needed. This provides a great deal of flexibility, scalability, and security for users of the network.