Exchange-traded funds (ETFs) are investment vehicles that track a variety of underlying assets, such as stocks, bonds, commodities, and indices. ETFs are similar to mutual funds in that they provide investors with an easy way to diversify their portfolios without having to purchase individual stocks or other securities. However, ETFs are more cost-effective and liquid than mutual funds, allowing investors to buy and sell shares of the fund throughout the day on a public exchange. ETFs also have the advantage of tracking a much broader range of assets than a single mutual fund, providing a greater level of diversification for investors.

Definition of ETFs

An Exchange Traded Fund (ETF) is a type of security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. It is traded on an exchange like stocks and trades at a price that reflects the value of the underlying assets. ETFs offer investors a way to diversify their portfolios and gain exposure to a variety of asset classes and investment strategies. ETFs are a popular choice for investors looking for a low-cost, diversified investment solution. ETFs are also tax efficient, meaning they are often more tax-efficient than other comparable investments.

How ETFs work

Exchange-traded funds (ETFs) are a type of investment fund that tracks an index, a commodity, bonds, or a basket of assets like an index fund. ETFs are traded like a common stock on a stock exchange. ETFs typically have lower fees and expenses than comparable mutual funds and can provide investors with an easy and cost-effective way to diversify their portfolio. ETFs are typically bought and sold on a secondary market, with buyers and sellers transacting in the open market. ETFs also have the potential to generate higher returns than mutual funds, as they are more tax-efficient, since they are not subject to the same taxes as mutual funds. ETFs also provide investors with more flexibility in terms of trading and diversification.

Types of ETFs

Exchange-traded funds (ETFs) are a popular way to invest in the stock market. They are a type of mutual fund that is traded on a stock exchange, just like stocks. ETFs can hold a variety of different assets, such as stocks, bonds, commodities, and currencies. Additionally, ETFs come in different forms, including index funds, sector funds, international funds, and leveraged funds. Index funds track a specific market index, such as the S&P 500, and provide broad-based, low-cost exposure to the market. Sector funds focus on a specific sector, such as technology, health care, or energy. International funds invest globally, while leveraged funds use derivatives to amplify returns.

Benefits of ETFs

Exchange-traded funds (ETFs) offer a number of benefits to investors. ETFs are a great way to diversify a portfolio as they can include a wide range of assets, such as stocks, bonds, commodities, and currencies. ETFs also provide a low cost way to invest since they have lower management fees and trading costs than traditional mutual funds. Additionally, ETFs are highly liquid and can be bought or sold quickly and easily, making them an attractive option for short-term traders. Lastly, ETFs allow investors to access a variety of markets, including international markets, without the need to purchase individual stocks or bonds. ETFs are an excellent way to diversify a portfolio and to access global markets.

Risks of ETFs

Exchange traded funds (ETFs) can be a great way to diversify a portfolio, but it is important to understand the associated risks. ETFs are subject to the same risks as any other investment, including the risk of market volatility, the risk of issuer default, and the risk of liquidity. ETFs may also be subject to tracking errors, which is when the fund’s performance does not match that of the underlying index. Investors should also be aware of additional risks associated with ETFs, such as high trading costs, which can reduce the overall return. It is important to research ETFs thoroughly and be aware of all associated risks before investing.

How to invest in ETFs

Investing in ETFs (Exchange Traded Funds) is a great way to diversify your portfolio and gain exposure to a variety of assets. To get started, you will need to open a brokerage account with an online broker and transfer your funds. Once the funds are in your account, you can search for ETFs that match your investment goals, such as broad market ETFs, sector ETFs, and international ETFs. Once you have chosen the ETFs you want to invest in, you can place an order with the broker and purchase the ETFs. Depending on the broker, you may need to pay a commission for each trade. It is important to keep in mind that ETFs can be subject to market volatility and you may experience losses. Therefore, it is important to research each ETF before investing and to maintain a diversified portfolio.

Strategies for investing in ETFs

A key strategy for investing in ETFs is to diversify your portfolio. Investing in multiple ETFs from different markets and sectors can help protect you from the risk of any one investment. Additionally, investors should keep a close eye on their investment goals and determine which ETFs are best suited to help them reach those goals. Additionally, setting up a stop-loss order can help protect investors from steep losses in the event of a sudden market downturn. Finally, it’s important to regularly monitor the performance of your ETFs and make adjustments as needed. This can help ensure that your portfolio remains well-balanced and aligned with your goals.

Tax implications of ETFs

Exchange-traded funds (ETFs) are a great way to invest in the stock market, but there are some important tax implications to consider. ETFs are subject to capital gains taxes, meaning when you sell your ETFs, you may have to pay taxes on any profits you have made. Additionally, ETFs may also be subject to taxation depending on the type of ETF. For instance, some ETFs are subject to dividend taxes and others may be subject to income taxes. As with any investment, it is important to do your own research and understand the taxes that apply to ETFs before investing.

Regulatory aspects of ETFs

Exchange-traded funds (ETFs) are regulated by the same laws and regulations that govern other securities. This includes the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Company Act of 1940. All ETFs must register with the Securities and Exchange Commission, and they must also meet certain requirements set forth by the Investment Company Act. Furthermore, ETFs must be approved by the SEC before they can be offered to the public. Additionally, ETFs must provide periodic disclosure of their activities and financial statements to the SEC. These regulations help ensure that investors are protected when investing in ETFs, as they help to ensure the accuracy and reliability of the information provided to investors.

The differences between ETFs and Mutual funds

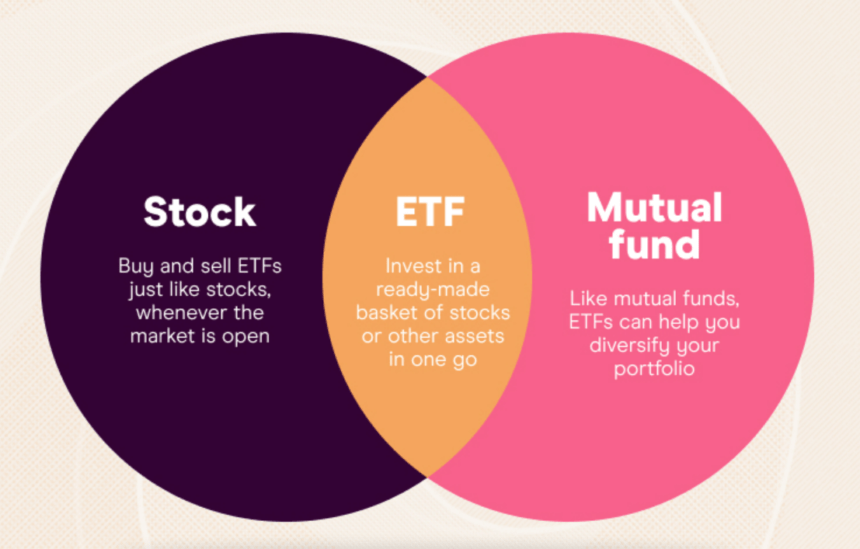

Exchange traded funds (ETFs) and Mutual funds are both investment products that allow individuals to diversify their portfolios and access the stock market. However, there are some key differences between the two. ETFs are generally more cost efficient than mutual funds and allow for greater flexibility when it comes to trading. ETFs are also more tax efficient because they don’t require investors to pay capital gains taxes when they sell shares. Mutual funds, on the other hand, are more actively managed, which can result in higher fees and lower potential returns. Additionally, mutual funds require investors to pay a capital gains tax when they sell their shares. Ultimately, ETFs and mutual funds both offer different benefits and drawbacks, so investors should carefully consider their individual needs and goals before deciding which type of fund to invest in.

The differences between ETFs and Stocks

ETFs (Exchange-Traded Funds) and stocks are similar in that they are both investments that can be bought and sold on the stock market, however, they have some key differences. ETFs are a type of investment fund that holds a basket of assets such as stocks, bonds, commodities, or other investments. They are usually passively managed, which means they track an index, such as the S&P 500, and are designed to provide investors with broad exposure to a specific market. On the other hand, stocks are investments in individual companies that can be bought and sold on the stock market. Stocks are actively managed and can be more volatile than ETFs. The primary difference between ETFs and stocks is that ETFs provide diversified exposure to a wide range of investments, whereas stocks are focused on a single company.