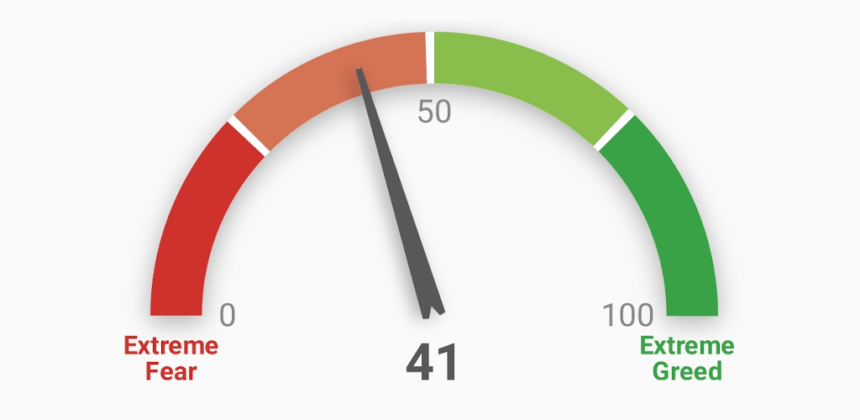

The Crypto Fear and Greed Index is a measure of the market sentiment in the cryptocurrency space. It is a tool that helps investors analyze the current state of the market and make decisions about how to invest. The index uses a combination of factors, including market volatility, social media trends, and trading volume, to assign a score between 0 and 100. A score of 0 indicates extreme fear and a score of 100 indicates extreme greed. By monitoring the score, investors can get an idea of the overall sentiment in the market and make more informed investment decisions.

The concept of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a tool used to measure the sentiment of the crypto market. It uses a scale of 0 to 100 to display the current sentiment of the market, with 0 being ‘Extreme Fear’ and 100 being ‘Extreme Greed’. The index uses several different variables, including volatility, market volume, sentiment, and social media activity, to calculate the overall sentiment of the market. By using the index, investors and traders can get an idea of how much fear or greed is currently in the market and make informed decisions accordingly.

The impact of the Crypto Fear and Greed Index on cryptocurrency investing

The Crypto Fear and Greed Index is an important tool for cryptocurrency investors. It is a tool that helps investors gauge the current state of the cryptocurrency market by measuring the sentiment of market participants. The index ranges from 0 (extreme fear) to 100 (extreme greed). When the index is low, investors can take advantage of the fear in the market and buy more cryptocurrencies at lower prices; conversely, when the index is high, investors should be cautious and possibly reduce their holdings. By monitoring the Crypto Fear and Greed Index, investors can make smarter and more informed decisions when investing in cryptocurrencies.

The different components of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a great tool for investors to gauge the sentiment of the overall cryptocurrency market. It does this by taking into account the volatility, market momentum, volume, social media, surveys, and dominance of the market. By examining these different components, investors can get a better sense of where the market is heading and whether or not it is a good time to invest in cryptocurrency. This index can be a valuable tool for investors to make educated decisions about their investments.

The relationship between cryptocurrency prices and the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a tool used to measure market sentiment in the cryptocurrency world. It is based on multiple factors such as volatility, market momentum, and volume. This index can be a useful indicator to analyze the relationship between cryptocurrency prices and the sentiment of the market. By looking at the index, investors can make informed decisions regarding their investments. For instance, when the index is high, it could indicate that the market is in a “fearful” state, which means it may be a good time to buy, whereas when the index is low, it could suggest the market is “greedy,” so it may be a good time to sell. Therefore, analyzing the relationship between cryptocurrency prices and the Crypto Fear and Greed Index can be a powerful tool for investors.

Overview of historical data about the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a tool created by alternative.me that analyzes market sentiment and provides an overview of historical data. It tracks the emotions of the crypto market by monitoring various data points such as volatility, volume, social media, and surveys. The index ranges from 0 to 100 and provides a snapshot of the current state of the market, with 0 being extreme fear and 100 being extreme greed. The historical data provided by the Crypto Fear and Greed Index allows investors to measure the sentiment of the market over time and make more informed decisions.

The advantages and disadvantages of using the Crypto Fear and Greed Index as a trading signal

The Crypto Fear and Greed Index is an index that is used by traders to gauge the sentiment in the crypto market. The index ranges from 0 to 100, with 0 representing extreme fear and 100 representing extreme greed in the market. This index can be used as a trading signal to help traders make decisions about when to enter and exit the market. The advantages of using the Crypto Fear and Greed Index as a trading signal include the ability to quickly and easily identify market sentiment, as well as the ability to make more informed decisions about when to enter and exit the market. On the other hand, the disadvantages of using the Crypto Fear and Greed Index as a trading signal include the possibility that the index can be misleading, as well as the fact that the index does not take into account other factors that may influence trading decisions.

5 Pros of using Crypto Fear and Greed Index as a trading signal

- Easy to understand and can provide a good indication of the market sentiment

- Can provide insight into whether a particular asset is overbought or oversold

- Can help traders to identify potential buying or selling opportunities

- Can be used as a broad indicator of the overall market direction

- Can help traders to make better decisions in terms of entry and exit points in the markets

5 Cons of using Crypto Fear and Greed Index as a trading signal

- Not all crypto markets are represented

- Not a guaranteed indicator of future performance

- Can be easily manipulated by large players in the market

- Not a reliable measure of sentiment

- Does not take into account other factors that may affect the market such as news or macroeconomic data