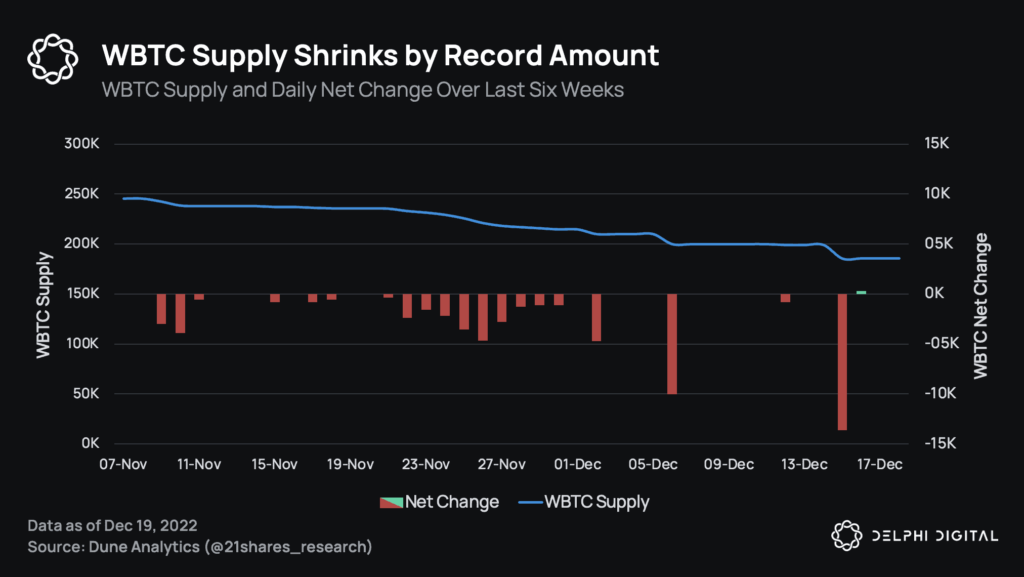

The month of November saw an unprecedented surge in the redemption of WBTC, with 30.6K WBTC redeemed – the highest amount ever since the token was first launched. As a result, the WBTC supply has subsequently shrunk by an impressive 24%. December is already proving to be a record-breaking month, with 29.1K WBTC redeemed thus far and more expected in the coming days. It is clear that WBTC is becoming increasingly popular and that its usage is steadily growing.

On December 15th, 2022, the largest daily redemption of WBTC on record took place, with 13.6K WBTC (worth $239M) being burned. This was the third of four major daily redemptions that occurred in December, all of which were completed by market maker Wintermute. This record-setting redemption marked a major milestone for WBTC and demonstrates the blockchain’s increasing popularity and use.

What is WBTC?

WBTC (Wrapped Bitcoin) is an ERC-20 token that is backed 1:1 with Bitcoin. The Bitcoin used to collateralize the WBTC is held in secure custody by BitGo, a leader in digital asset security. The minting and redemption of WBTC can only be completed by approved merchants and exchanges, which are typically market makers. This ensures that the WBTC is backed by real Bitcoin and that its value can be trusted. WBTC allows users to benefit from the advantages of Bitcoin on Ethereum, such as faster and cheaper transactions, while still having the same value as Bitcoin.

WBTC has become a popular choice amongst users due to its transparency. All transactions are visible on the blockchain, and users can easily verify the amount of WBTC in circulation versus the amount of BTC held in custody. This open and accessible data has given users the confidence to trust in WBTC as a safe and reliable form of digital currency. The transparency of WBTC has been a key factor in its widespread adoption.

The introduction of Wrapped Bitcoin (WBTC) has been a positive development for the crypto market, as it allows Bitcoin to be used in the Ethereum-based DeFi space. This is a crucial step to bridge the gap between Bitcoin and DeFi, as it allows users to convert BTC to WBTC and vice versa. The process of converting WBTC to BTC is a mechanism that helps to maintain market confidence in the token, as it minimizes the possibility of a “bank run” during a crisis of confidence. This is because market participants are likely converting WBTC to BTC in order to either sell the tokens or custody the BTC themselves. This ensures that there is an exit option in case of an emergency, leading to greater market stability.