Do you want to understand the implications of the Death Cross in the world of cryptocurrency trading? Then this blog is for you. We will take a deep dive into the phenomenon of the Death Cross and explore how it can be used to identify trends in the cryptocurrency markets. We will also discuss the risks associated with trading with the Death Cross and strategies to maximize profits. So, let’s get started!

What is the Death Cross?

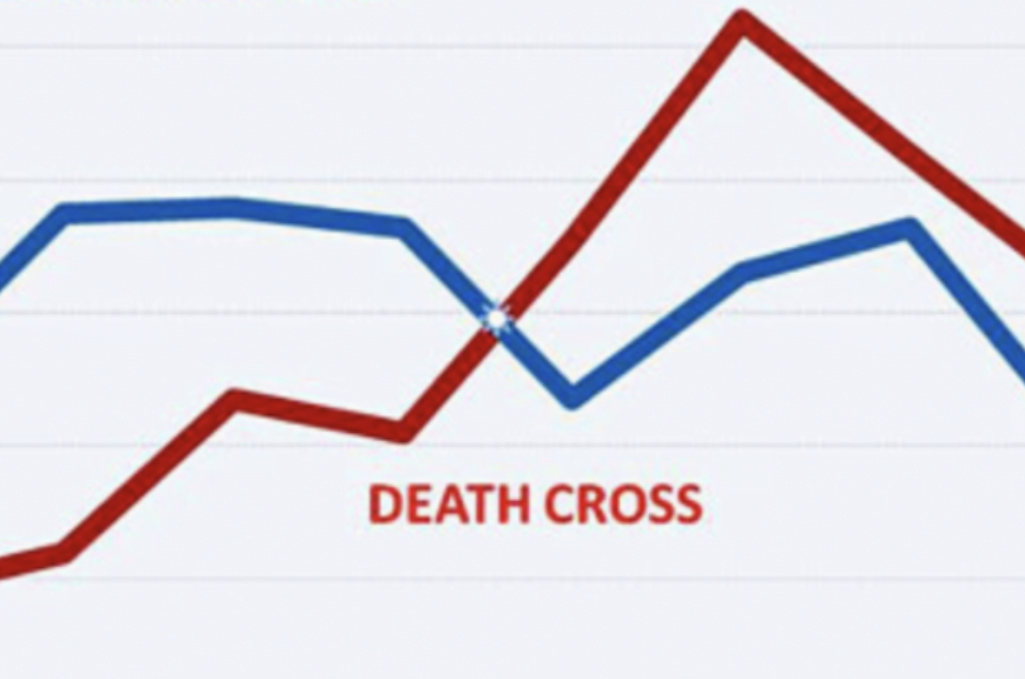

The Death Cross is a technical indicator used to identify bearish trends in the markets. It is a chart pattern that occurs when the 50-day moving average of a stock or cryptocurrency crosses below the 200-day moving average. This indicates that the asset is in a strong bearish trend and that investors should be cautious.

The Death Cross is a fairly reliable indicator of a bearish trend and has been used by traders for decades. It is a popular tool among technical analysts and traders of all levels, as it can be used to identify bearish trends before they occur.

The History of the Death Cross

The Death Cross has been around since the early 1900s. It was first used by the legendary investor and economist, John Maynard Keynes, to identify bearish trends in the stock markets. Since then, it has become a popular tool among technical analysts and traders.

The Death Cross is often used in conjunction with other indicators and tools, such as the Golden Cross, to gain a better understanding of the markets. It is also used to identify potential entry and exit points for trading.

How Does the Death Cross Affect Cryptocurrency Trading?

The Death Cross is a powerful tool for identifying bearish trends in the cryptocurrency markets. By monitoring the 50-day and 200-day moving averages of popular cryptocurrencies, traders can identify potential bearish trends before they occur. This can help them make more informed trading decisions and maximize their profits.

The Death Cross is also used to identify potential entry and exit points for trading. By monitoring the Death Cross indicator, traders can identify when it is a good time to enter a trade or when it is time to exit a trade. This can help them reduce their risk and maximize their profits.

Difference Between the Death Cross and the Golden Cross

The Death Cross and the Golden Cross are two very different indicators. The Death Cross is a bearish indicator, while the Golden Cross is a bullish indicator.

The Death Cross is formed when the 50-day moving average crosses below the 200-day moving average. This indicates that the asset is in a strong bearish trend and that investors should be cautious.

The Golden Cross, on the other hand, is formed when the 50-day moving average crosses above the 200-day moving average. This indicates that the asset is in a strong bullish trend and that investors should be bullish.

What Are the Risks of Trading with the Death Cross?

Trading with the Death Cross can be risky, as it is a bearish indicator. When the Death Cross appears, it indicates that the asset is in a strong bearish trend, which can lead to losses if the trader is not careful. Therefore, traders need to use other indicators and tools to confirm the Death Cross before taking any action.

In addition, traders should be aware of the potential for false signals. The Death Cross can sometimes appear before a major uptrend, indicating a bearish trend when, in fact, the asset is in a strong bullish trend. Therefore, traders need to use other indicators and tools to confirm the Death Cross before taking any action.

How to Identify a Death Cross

Identifying a Death Cross is fairly simple. All you need to do is look at the 50-day and 200-day moving averages of the asset in question. If the 50-day moving average crosses below the 200-day moving average, then the Death Cross has occurred.

It is important to note that the Death Cross can be used in conjunction with other indicators and tools to gain a better understanding of the markets. For example, traders can use the Death Cross in conjunction with the Golden Cross to confirm the trend.

Strategies for Trading with the Death Cross

When trading with the Death Cross, traders should be aware of the potential risks. As the Death Cross is a bearish indicator, traders should be cautious when entering trades. This means that traders should look for confirmation from other indicators and tools before taking any action.

In addition, traders should also set stop losses and take profits to minimize their losses. This means that traders should set a limit on their losses and take profits when the market moves in their favor. This will help them reduce their risk and maximize their profits.

Finally, traders should also use the Death Cross in conjunction with other indicators and tools. This will help them gain a better understanding of the markets and make more informed trading decisions.

How to Trade Around the Death Cross

Traders can use the Death Cross to identify potential entry and exit points for trading. When the Death Cross appears, traders should look for confirmation from other indicators and tools before taking any action.

In addition, traders should also look for bearish reversal patterns, such as head and shoulders or double tops. These patterns can help traders identify potential entry and exit points for trading.

Finally, traders should look for opportunities to go long on the asset. This means that traders should look for bullish reversal patterns, such as double bottoms or inverted head and shoulders. These patterns can help traders identify potential entry and exit points for trading.

Understanding and Analyzing the Death Cross Indicator

To make successful trades with the Death Cross, traders must understand how to interpret the indicator. The Death Cross is a bearish indicator, so traders should be cautious when entering trades.

In addition, traders should also look for confirmation from other indicators and tools before taking any action. This means that traders should use the Death Cross in conjunction with other indicators and tools to gain a better understanding of the markets.

Finally, traders should also look for bearish and bullish reversal patterns to identify potential entry and exit points for trading. This will help them reduce their risk and maximize their profits.

Definition of a Death Cross and how it impacts cryptocurrency trading

A Death Cross is a technical analysis pattern that is identified when the short-term moving average of a cryptocurrency crosses below its long-term moving average. This pattern is seen as a bearish signal, indicating that the security is likely to decrease in value in the near future. As a result, traders often take this as a cue to sell their cryptocurrency holdings. The Death Cross pattern is a trend reversal pattern that can be used to identify potential buying opportunities when the market sentiment turns bullish. Traders should use caution when trading in the wake of a Death Cross as the market may be in a downward trend and could remain so for some time.

How to interpret a Death Cross in cryptocurrency trading

A Death Cross in cryptocurrency trading is when the 50-day moving average crosses below the 200-day moving average. This is usually seen as a negative sign in the market, indicating that investors are selling and that prices could drop in the near future. It is important to interpret this signal in the context of the overall market and other signals, as it alone should not necessarily be seen as a sign to sell. It can indicate a good time to consider taking profits if you have made any gains, but it is important to do further research to make sure you are making the right decision.

Strategies for traders to consider when a Death Cross appears

When a death cross appears, traders should consider a few strategies that can be used to capitalize on this occurrence. One strategy is to identify support and resistance levels, as these can help traders determine when to enter and exit a position. Additionally, traders should look for any divergences in the price, as these can indicate potential reversals. Traders should also look for any fundamental news or events that could impact the security, as these could also provide clues as to the direction of the price. Finally, traders should make sure they are using a risk management strategy, such as stop losses, to limit any losses they may incur. By implementing these strategies when a death cross appears, traders can maximize their chance of success.

The potential risks associated with trading during a Death Cross

Trading during a Death Cross carries potential risks that investors should be aware of. A Death Cross occurs when the 50-day moving average crosses below the 200-day moving average, and is seen as a bearish signal. During this time, the stock market can become volatile and investors may experience a sharp decline in the value of their investments. Additionally, trading during this time can be more risky because it is difficult to predict which stocks will perform positively and which will suffer losses. Therefore, it is important for investors to be aware of the potential risks associated with trading during a Death Cross in order to make informed decisions.

Historical data on Death Crosses in cryptocurrency trading

Death Crosses are an important technical analysis tool used in cryptocurrency trading. A Death Cross occurs when a short-term moving average crosses below a long-term moving average, signaling a bearish trend in the market. Historical data on Death Crosses in cryptocurrency trading can be a valuable resource for investors looking to make informed decisions about when to enter and exit the markets. By studying the performance of past Death Crosses, investors can obtain a better understanding of the market trends and make more informed trading decisions. Additionally, historical data can help investors identify potential buying and selling opportunities in the future.

The potential for an uptrend after a Death Cross

After a Death Cross occurs, there is potential for an uptrend. A Death Cross happens when a short-term moving average crosses below a longer-term moving average, and is typically seen as a bearish indicator in the market. However, there is still potential for an uptrend when a Death Cross occurs. This can happen if the market is oversold, as it could mean that the bearishness has been overplayed, and the market is due for a rebound. Traders should be aware of this potential and be ready to take advantage of any potential uptrends that may occur after a Death Cross.

Conclusion

The Death Cross is a powerful tool for identifying bearish trends in the cryptocurrency markets. By monitoring the 50-day and 200-day moving averages of popular cryptocurrencies, traders can identify potential bearish trends before they occur. This can help them make more informed trading decisions and maximize their profits.

However, traders need to understand the risks associated with trading with the Death Cross. They should also look for confirmation from other indicators and tools before taking any action. Finally, traders should also look for bearish and bullish reversal patterns to identify potential entry and exit points for trading.

By understanding and analyzing the Death Cross indicator, traders can reduce their risk and maximize their profits. So, if you are a cryptocurrency trader, then it is important to understand the Death Cross and its implications for your trading.