Tomorrow marks the options expiry for a total of $4.6 billion worth of Bitcoin and Ethereum. This large amount of cryptocurrency could result in some significant market movement, so traders and investors should be on the lookout. As we are also in the final month of the year, the end of 2023 could cause some interesting changes in the crypto market. Be sure to keep an eye on the markets and be prepared for any potential shifts that may take place.

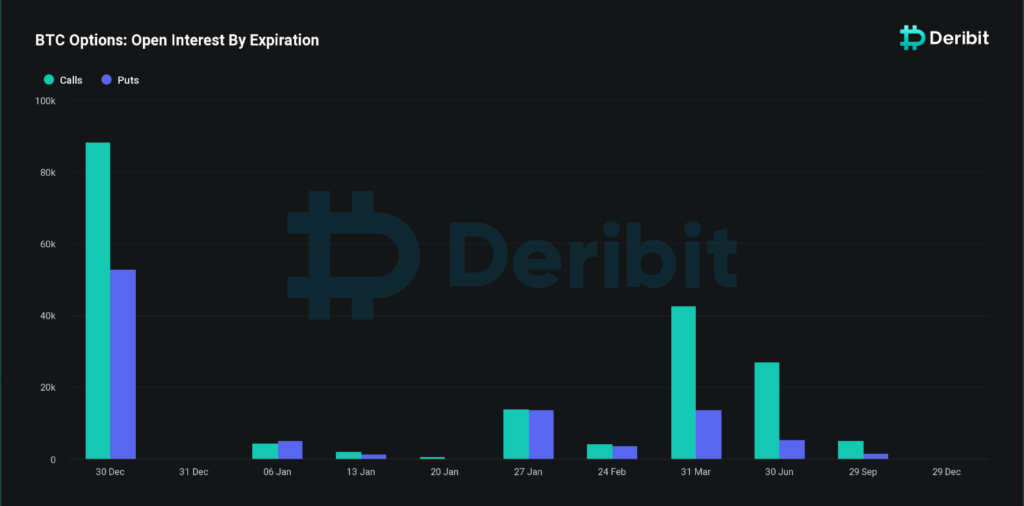

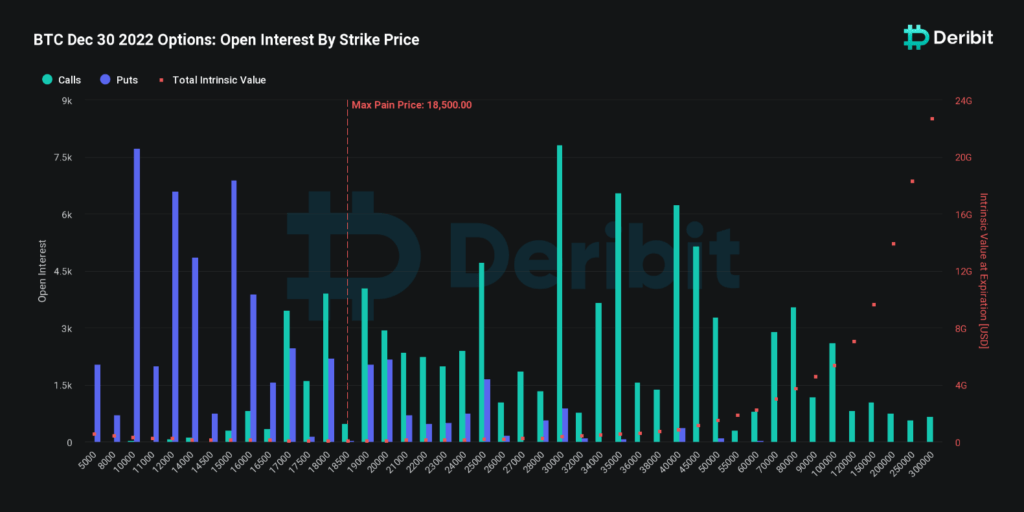

Bitcoin BTC:

- $2.3 B Notional Value

- Put/Call Ratio 0.60

- MP $18.500

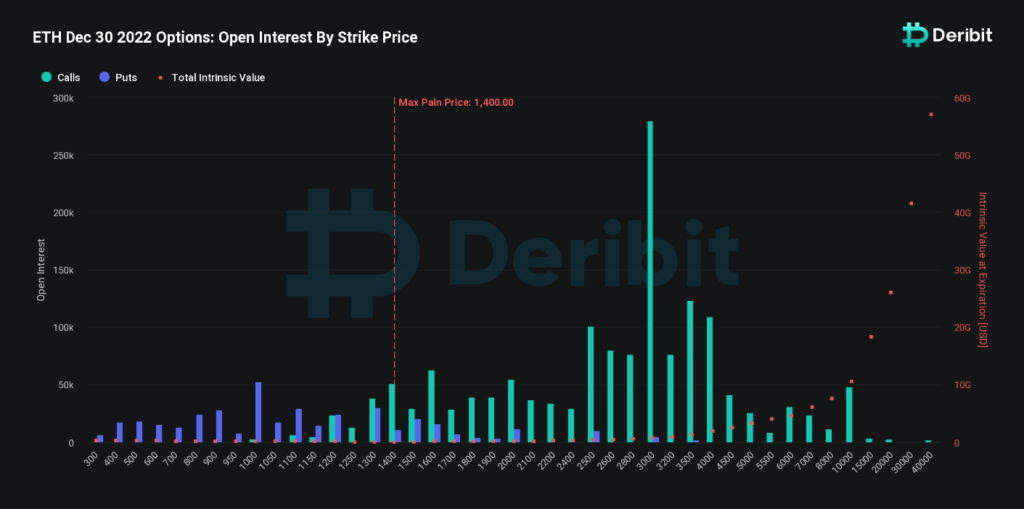

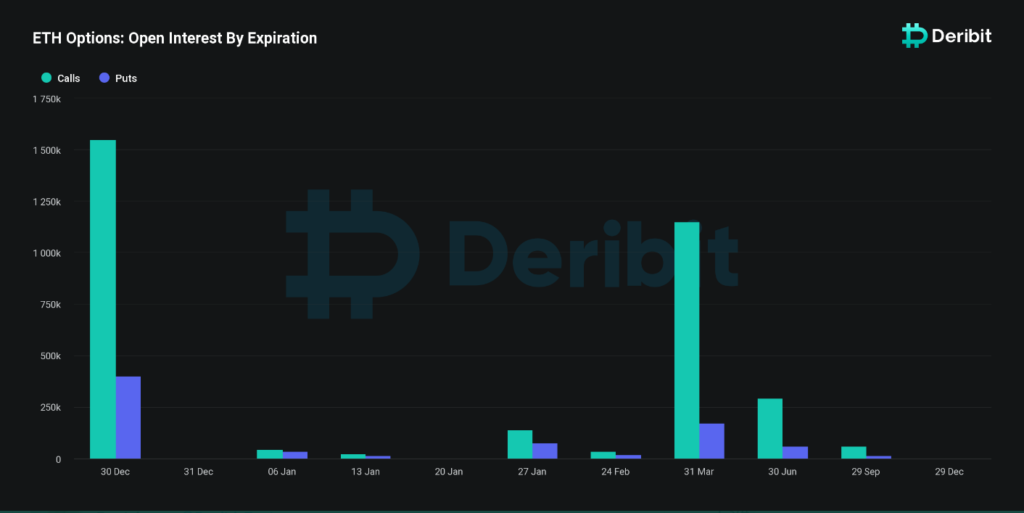

Ethereum ETH:

- $ 2.3 Billion Notional Value

- Put/Call Ratio 0.26

- MP $1400

Tomorrow marks the options expiry for a total of $4.6 billion worth of Bitcoin and Ethereum. This large amount of cryptocurrency could result in some significant market movement for Bitcoin price and Ethereum price, so traders and investors should be on the lookout. As we are also in the final month of the year, the end of 2022 could cause some interesting changes in the crypto market. Be sure to keep an eye on the markets and be prepared for any potential shifts that may take place.

Tomorrow’s options expiry of Bitcoin and Ethereum, with max pain at $18.5k for BTC and $1400 for ETH respectively, is likely to result in a price movement towards the max pain levels. However, this may not occur if stocks tank, which is a possibility. Funding rates on Bitcoin have been steadily increasing for a few days with no significant price movement, indicating a possible move down. Therefore, it is uncertain as to which direction the prices of Bitcoin and Ethereum will go.

This is a large amount of money and the expiry could have a big impact on the prices of these two highly volatile tokens. As such, traders should be prepared to adjust their strategies to take advantage of any potential changes in the market. It is important to be familiar with the different options strategies and to be aware of the risks associated with them in order to maximize profits and minimize losses. Traders should also keep a close eye on the news, as any major news developments could also have an impact on the prices of Bitcoin and Ethereum.

As we approach the end of the year, there could be some interesting changes in the crypto market. The crypto market is known for its volatility, so investors should be prepared for a wide range of potential outcomes. We could see a surge in prices, as investors take advantage of the bear market and look for ways to capitalize on the weakened prices, or prices could drop further as traders sell off assets for fear of a bear market. There are also more regulatory changes on the horizon, which could inspire further market changes. No matter what, it is important to stay informed and up to date on the latest developments in the crypto market.