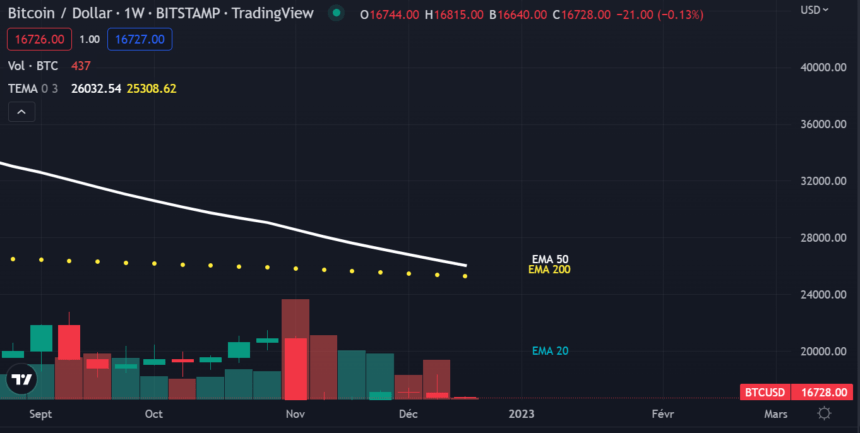

As Bitcoin continues to trade above its current price, traders are beginning to take notice of an impending Death Cross that could spell disaster for the cryptocurrency market. If the Death Cross does occur, which may happen a few weeks away from now, it will be a clear bearish confirmation, meaning that the price of Bitcoin could potentially plummet below 14,000 USD and beyond. This could have a significant impact on the market, and it is something that investors should be closely monitoring in the coming weeks. As we approach the Death Cross, traders and investors should remain vigilant and take all necessary precautions to protect their investments.

Potential impacts of the upcoming Bitcoin Death Cross

The upcoming Bitcoin Death Cross is a potential market event that could have a large impact on the value of Bitcoin. The Death Cross occurs when the 50-day moving average of a security’s price drops below its 200-day moving average. This is a bearish indicator that could potentially lead to a prolonged period of price declines. Therefore, it is important to look into the potential impacts of the upcoming Bitcoin Death Cross on the cryptocurrency market. Analysts are expecting the Death Cross to lead to significant drops in Bitcoin’s price, with some anticipating it to drop as low as $4,000. It is important to take these predictions into account when making investment decisions and to make sure that you are aware of the potential risks associated with the upcoming Bitcoin Death Cross.

[ccpw id=3289]

Bitcoin market trends ahead of the Death Cross

The Bitcoin market is currently facing an important trend to analyze ahead of the so-called “Death Cross”. The Death Cross is a technical signal which occurs when the 50-day moving average crosses below the 200-day moving average, and is usually seen as an indication of bearish momentum in the market. It is therefore important to carefully analyze the current Bitcoin market trends in order to be prepared for the potential outcome of the Death Cross. Analyzing current market trends can provide an indication of the direction the market is likely to take when the Death Cross occurs, so investors should carefully look at the recent market movements and news about Bitcoin to make an informed decision about their investments.

The psychological effects of the Death Cross on Bitcoin investors

The Death Cross is a technical indicator which is used to measure the health of a stock or cryptocurrency. It occurs when the 50-day moving average crosses below the 200-day moving average. It is believed to be a bearish sign and can lead to a major sell-off in the asset. This event can have a psychological effect on Bitcoin investors, as it can cause fear and panic among them. Fear of further losses and panic selling can cause investors to become irrational and make bad investment decisions. This can lead to a snowball effect, where the price drops even further due to the lack of confidence in the asset. Therefore, it is important for Bitcoin investors to remain calm and take the time to analyze the market before making any decisions.

The potential risks and opportunities of the Death Cross for Bitcoin

The Death Cross for Bitcoin is an indicator that warns of a potential bearish trend in the cryptocurrency’s price. As such, investors should assess the potential risks and opportunities associated with this indicator. On the one hand, a Death Cross can signal a bearish trend, meaning that investors may need to be prepared to sell their holdings in order to avoid potential losses. On the other hand, it can also be a sign of a potential opportunity, as investors may be able to buy Bitcoin at a discounted price and take advantage of a potential price rebound. Therefore, investors must weigh the potential risks and opportunities associated with the Death Cross before making investment decisions.

Strategies to mitigate the risks associated with the Death Cross

One of the best strategies to mitigate the risks associated with the Death Cross is to use stop-loss orders. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. This will help to limit losses in the event that the Death Cross signals a major trend reversal. Additionally, investors should also diversify their portfolio by investing in different asset classes and using different strategies. This will help to reduce the risk of losses if the Death Cross signals a bearish trend. Finally, it is important to stay up to date with the latest market news and trends to ensure that the Death Cross is properly interpreted and understood. Following these strategies can help to mitigate the risks associated with the Death Cross.

The recent historical data to better predict the Death Cross’s effects on Bitcoin prices

Analyzing the recent historical data to better predict the Death Cross’s effects on Bitcoin prices is an important way to make informed decisions in the cryptocurrency market. By looking at past occurrences of the Death Cross, we can gain insight into the potential implications of the pattern on the price of Bitcoin. This analysis can include evaluating the length of time that the Death Cross occurred, the frequency of the pattern, and the magnitude of the decrease in Bitcoin prices. Additionally, other factors such as the magnitude of the market sentiment and the overall health of the cryptocurrency market at the time of the Death Cross should also be taken into consideration. By understanding the effects of the Death Cross on the prices of Bitcoin in the past, one can gain valuable insight into the potential implications of the pattern on the price of Bitcoin in the future.