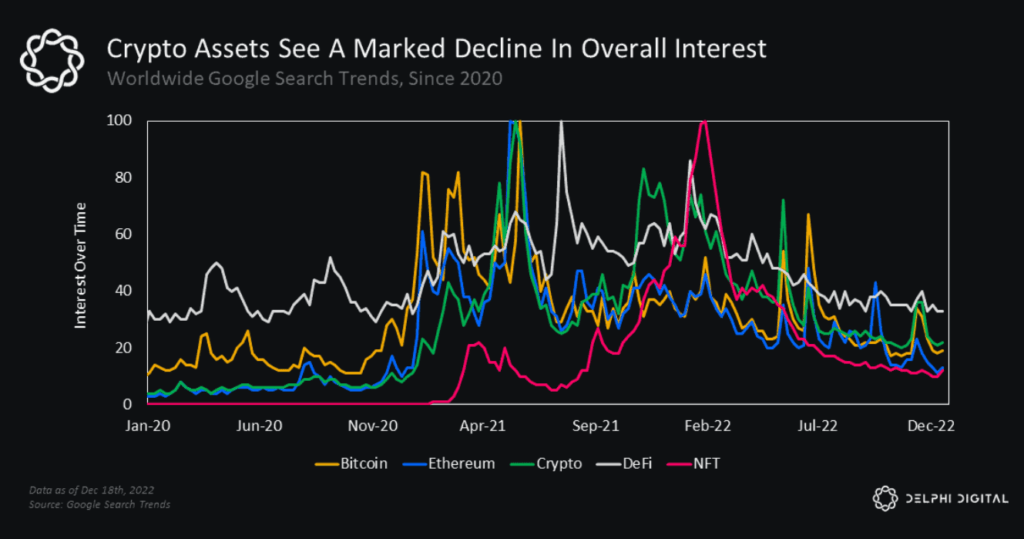

Based on a graph from Google Trends put together by Delphi Digital that showcase the interest overtime of Google users towards Crypto from January 2020 to December 2022, we noticed a consistent downward trend in the interest of the most prominent crypto currencies such as Bitcoin, Ethereum, and other crypto assets such as Defi and NFT since February 2022. This could have a major impact on the crypto currency market, as the lack of interest could lead to decreased investment in the short and long terms. Therefore, it is important to pay close attention to the developments in the crypto market, and to be aware of the potential risks associated with investing in crypto currencies.

5 reasons for the disinterest of people in cryptocurrencies since the beginning of 2022

Uncertainty of cryptocurrency regulation by governments

The uncertainty surrounding cryptocurrency regulation by governments has been a major roadblock to the mainstream adoption of digital assets. Governments around the world are still trying to figure out what their official stance towards cryptocurrency should be, and in some cases, there is a fear of the unknown. As a result, it is difficult to predict what legislation may be passed, and how it may affect the cryptocurrency industry in the future. This creates an environment of uncertainty for businesses and investors alike, as there is no guarantee of regulatory clarity in the near future.

Difficulty of understanding the complicated technology behind cryptocurrencies

Understanding the complicated technology behind cryptocurrencies can be very difficult, especially for those who are not tech-savvy or who are not familiar with the blockchain technology used to create them. Cryptocurrencies are a complex mix of cryptography, computer science, mathematics, and economics that require a great deal of knowledge and expertise to fully comprehend. The sheer size and complexity of the underlying technology can make it difficult for even the most experienced developers to understand and utilize. For this reason, it is important for those interested in investing in cryptocurrencies to do extensive research and to seek out the help of experts in the field in order to understand the technology and make informed investment decisions.

Fluctuations in the value of cryptocurrencies

Cryptocurrencies have become increasingly popular in recent years and have seen a large increase in the number of investors and traders. However, due to their lack of regulation, they are highly volatile and subject to large fluctuations in value. This volatility can make them highly profitable, but also extremely risky. As such, investors must be aware of the risks associated with cryptocurrencies and familiarize themselves with the market before investing. Furthermore, because of the large fluctuations, it is important to stay up to date on news and events that could affect the market value of cryptocurrencies.

Unclear incentives for individuals to invest in cryptocurrencies

Investing in cryptocurrencies can be a risky endeavor, with unclear incentives for individuals to do so. Cryptocurrency prices are highly volatile and the market is largely unregulated, making it difficult to assess the potential returns on investment. Furthermore, there is no guarantee that the coins you buy today will retain their value in the future. With the lack of clarity over the potential rewards and the risks involved, many potential investors are hesitant to take the plunge and invest in cryptocurrencies.

Limited usage of cryptocurrencies in everyday life

Cryptocurrencies are digital currencies that can be used to purchase goods and services. However, the usage of cryptocurrencies is still relatively limited in everyday life. This is due to the fact that cryptocurrencies are still in their infancy and the infrastructure that would allow their widespread use is not yet in place. As more businesses and individuals become comfortable with the concept of cryptocurrencies, their usage will likely become more commonplace. Currently, the most common uses for cryptocurrencies are as a store of value, an investment assets, and as a medium of exchange.