Bitcoin halving is an event that occurs roughly every four years in which the reward for mining Bitcoin is cut in half. This is a built-in mechanism to control the supply of Bitcoin and keep inflation in check. The halving reduces the number of new Bitcoins generated per block, meaning miners receive 50% fewer Bitcoins for verifying transactions. This is intended to keep the Bitcoin network secure and maintain the long-term value of the cryptocurrency. With fewer new Bitcoins, the existing tokens become more valuable, making them harder to acquire. As the mining reward is reduced, the value of Bitcoin is expected to increase, which could lead to a surge in its price. The most recent halving of the Bitcoin currency happened in May of 2020, with the next one estimated to occur in 2024. But what is a halving, what impact does it have on the cost, and what could it indicate for miners and the future of the digital currency?

Definition of Bitcoin Halving

Bitcoin halving, also known as “the halvening,” is a process that occurs on the Bitcoin blockchain every 210,000 blocks, or roughly every four years. During this process, the reward miners receive for successfully verifying transactions is cut in half. This process is designed to control the supply of Bitcoin and keep its inflation rate low. The halving reduces the rate at which new Bitcoins are created and released into circulation. It is a significant event in the cryptocurrency world, as it can affect the price of Bitcoin.

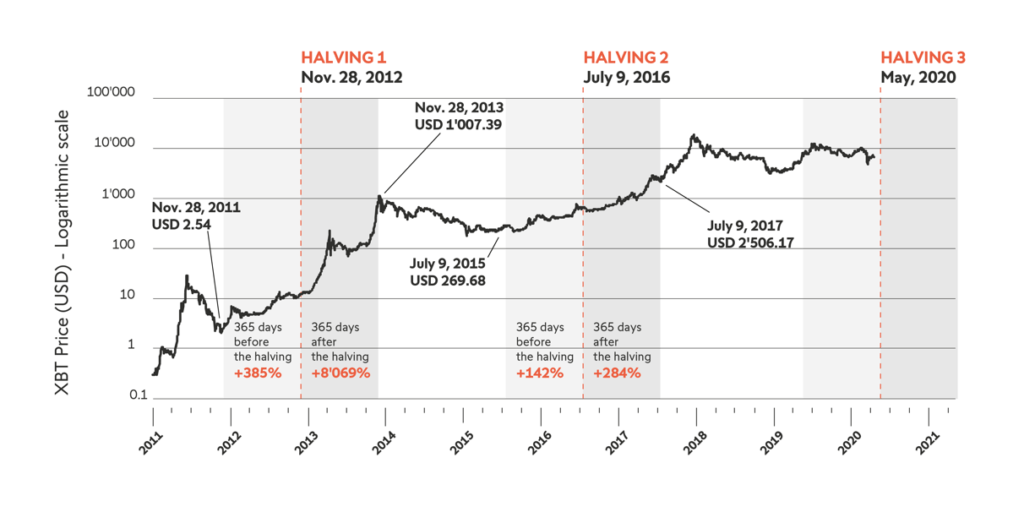

History of Bitcoin Halving

The history of Bitcoin Halving dates back to the original creation of Bitcoin. In 2009, the first Bitcoin halving took place, reducing the reward miners received for creating a new block from 50 bitcoins to 25 bitcoins. This event, which is now known as the first halving, marked the beginning of Bitcoin’s deflationary monetary policy. Every 210,000 blocks, or roughly every four years, the reward for mining a new block is cut in half. This serves to control the inflation of Bitcoin’s circulating supply and helps to keep the value of Bitcoin stable. There have been two more halvings since the first one in 2009 and the fourth one is scheduled for May 2020.

Impact of Bitcoin Halving

The Bitcoin Halving is a significant event for the cryptocurrency community, as it reduces the amount of Bitcoin that miners can receive as a reward for processing blocks of transactions on the network. This halving occurs every 210,000 blocks, and reduces the rewards by 50%, making it increasingly difficult to mine Bitcoin. The impact of the halving is that it reduces Bitcoin’s inflation rate, as fewer coins enter circulation, and also increases its scarcity which leads to an increase in its market value. This can make Bitcoin more attractive to investors, as they are more likely to hold on to their coins in anticipation of price increases. As a result, the halving can have a positive effect on the value of the cryptocurrency in the long-term, although it may take some time for these effects to be seen.

Benefits of Bitcoin Halving

The Bitcoin halving is a process that occurs roughly every four years and is designed to limit the number of Bitcoins that can be mined. The result of Bitcoin halving is that the rate at which new Bitcoins enter the market is cut in half, which significantly affects the supply and demand dynamics of the market. The benefits of Bitcoin halving include a decrease in inflation, an increase in the scarcity of Bitcoin, and a potential increase in the value of the coin. This process is a key event in the Bitcoin ecosystem that helps to keep the coin scarce and valuable.

5 Pros of Bitcoin Halving

- Increased scarcity of Bitcoin, resulting in increased demand and higher prices

- Potential for miners to become more efficient and reduce costs

- Longer time between halvings, allowing for greater price stability

- Increased confidence from investors who view the halving as a sign of maturity for the asset

- Increased possibility for new investors to enter the market and take advantage of the halving event

5 Cons of Bitcoin Halving

- Increased volatility in the Bitcoin market

- Lower prospects for Bitcoin miners

- Difficulty in maintaining a consistent rate of return

- Higher risk of reduced liquidity in the market

- Difficulty in predicting the future price of Bitcoin

How to Prepare for Bitcoin Halving

Preparing for Bitcoin halving is a critical step for anyone who is interested in investing in Bitcoin.

- The first step is to do extensive research on the subject.

- Reading up on the history of Bitcoin and what the halving event entails is essential.

- Additionally, it is important to stay informed on the latest news and updates related to Bitcoin.

- Another important step is to understand the basics of trading and investing in Bitcoin, such as setting up a wallet, understanding the different types of exchanges, and familiarizing yourself with technical analysis.

- Finally, it is important to understand the risk involved in investing in Bitcoin, such as market volatility and cyber security risks.

Technical Aspects of Bitcoin Halving

The Bitcoin halving is an event that takes place every four years, and is significant for the cryptocurrency community. It works by reducing the block reward for miners by half, which in turn reduces the amount of newly created Bitcoin into circulation. This has a direct effect on the supply and demand of the currency, which can cause an increase in the price. Technical aspects such as the complexity of the algorithms used to solve blocks and the rate of new block production can be affected by halving, as the amount of resources required to solve blocks increases. This can lead to a slower rate of block production, and a higher difficulty level for miners. Ultimately, the halving event is an important part of the Bitcoin system, and its effects should not be taken lightly.

Implications of Bitcoin Halving on the Crypto Market

The Bitcoin halving is an event that will have significant implications for the cryptocurrency market. This process, which occurs roughly every four years, reduces the amount of new bitcoin entering the market and is seen as a sign of market maturity. This reduction in new supply will likely cause an increase in the value of bitcoin, as demand remains strong and the number of new coins being released is lower. Additionally, the halving will reduce the amount of new coins entering the market and this could lead to increased scarcity, which could also contribute to a higher price. As the halving approaches, many investors will be watching closely to see how this event will impact the crypto market.